Investor engagement strategy: Step-by-step guide

With so many changes happening in the marketplace, this is a critical time for companies to engage investors effectively and with a well thought out investor engagement strategy. Engagement with stakeholders gives companies opportunities to focus on that will deliver long-term value to the shareholders and the company. In today's business world, an investor engagement strategy also gives companies new opportunities to communicate about Environmental, Social and Governance (ESG) and other issues that are necessary for long-term corporate survival.

Importance of Investor Engagement

Input from investors prevents companies from being self-serving and placing their whole focus inward. A successful investor engagement strategy requires companies to look at all investors and stakeholders, including those that aren't as active or vocal. By opening up and listening to a wide range of perspectives, corporations will gain the benefit of comprehensive feedback, which will allow them to develop the most appropriate feedback. Encouraging ongoing investor engagement is a modern approach to governance.

Corporate boards should be aware that today's investors have powerful in-person and social media networks. Solid strategies for investor engagement will help to build mutual trust between stakeholders and the company. The key to a good investor engagement strategy is to view investors through a new lens; shift to a two-way communications mindset; identify the right stakeholders; prepare, engage and work the action plan; and be willing to receive and use feedback.

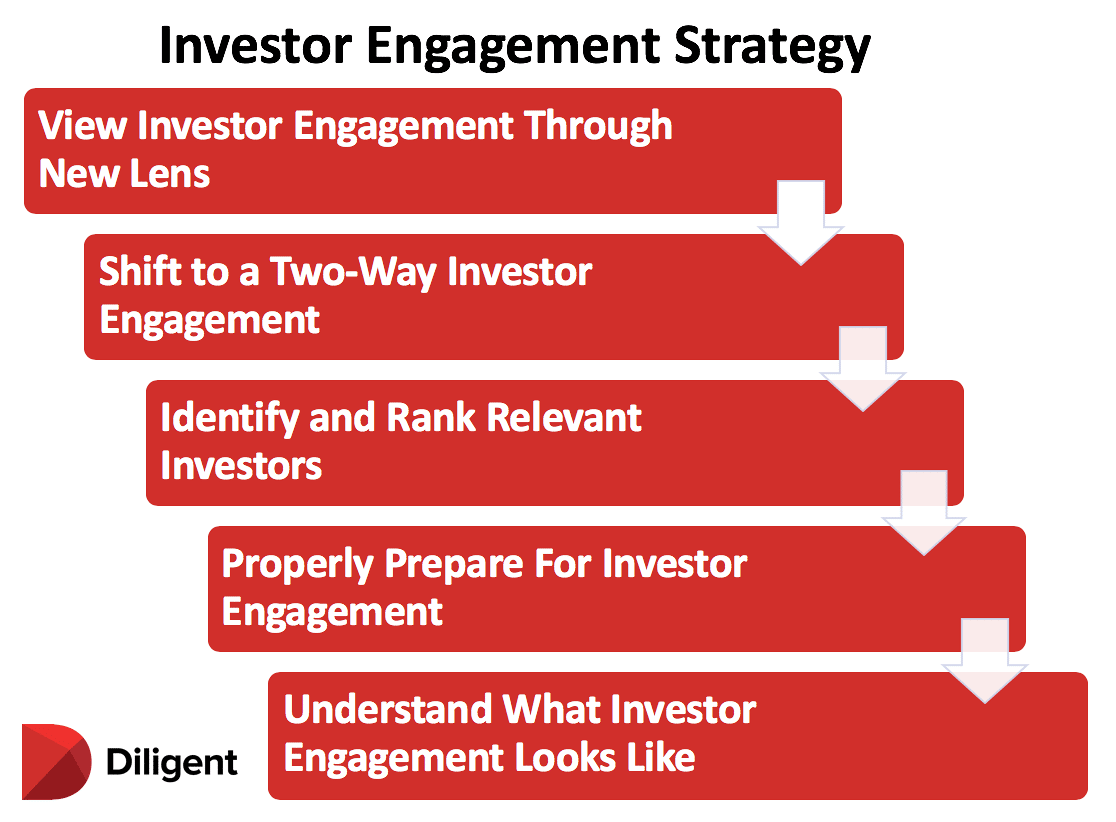

Investor Engagement Strategy

Here is a six-step plan to help you get started:

- View Investor Engagement Through a New Lens

You've heard it said that the squeaky wheel gets the grease. The loudest, most active investors are the ones that companies usually listen to. When developing an investor engagement strategy, it's important to consider all investors, especially the quiet ones.

In looking at investor engagement through a new lens, it's important to get buy-in from all departments and at all levels of the company. Having a designated plan for investor engagement will help companies navigate crises because the plan enables them to better anticipate risks and opportunities. Overall, investor engagement increases the return on equity, reduces costs and increases the value of the company.

Your new vision for engagement should build on the existing strategies of managing risks and reputations by adding partnership and collaboration to the mix. Global regulation is moving in a direction that may require this, so companies that are willing to revise their views of investor engagement will be ahead of the curve. Most importantly, be clear on what it is you want to accomplish with your new view of your investor engagement strategy.

- Shift to a Two-Way Investor Engagement

In creating a new vision for an investor engagement strategy, it's important to analyze where investor engagement is liable to have the biggest effect on strategy and operations. This step requires taking a quick look back at the history of experiences and discovering what the company can learn from them. Spend some time investigating how past experiences have shaped the company's objectives and its approach to goal-setting. Lessons from the past will help corporate leaders understand and manage investor expectations better.

Investor engagement requires more than sending out a public relations announcement, working to protect the company's reputation or getting involved in networking. Relationships require communication between at least two parties. Bear in mind that investors who are eager to engage are looking for some type of change.

- Identify and Rank Relevant Investors

This project will need a leader who is charged with accountability for it. The leader should be someone who is committed to diversity in relation to engagement. Consider the list of investors as a work in progress.

To begin with, the leader will need to identify relevant individuals, groups and organizations and determine what their focus areas are. From there, they'll need to analyze their importance and rank them by relevance. Consider the connections that investors have with each other. Question whether any of the investors have connections to the corporation's goals. Another good idea is to recruit the best possible cross-section of participants from inside the company to engage on the company's behalf.

- Prepare

In preparing for the engagement, determine the short- and long-term goals for the investor engagement strategy and keep these goals in mind during the planning and implementation stages. Be sure that the goals are clear and realistic.

The investor groups should be representative of a diverse group of stakeholders to ensure that the engagement plan is culturally sensitive and accessible. In the interests of diversity, be sure to include vulnerable or less vocal investors. Finally, be transparent about final outcomes by providing a summary of the interactions.

- Engage

The previous four steps will prepare you well for the actual engagement process. What will your formal engagement process look like? There are lots of ways to approach the engagement process. You could set up an external advisory council, collaboration meeting or stakeholder workshop. You could also work on a joint research project together, put out a survey or host a town hall-type meeting.

Decide on the frequency of your investor engagement strategy. Are you planning to meet just once, or will there be several meetings? Would it be more beneficial to have some type of ongoing dialogue?

Who could be a capable facilitator for such a meeting? Is it better to use a representative from the company or an objective, third-party facilitator? Whoever serves as facilitator should allow for equal contribution. It's possible that areas of tension between the parties may surface, so facilitators will need to anticipate areas of tension and have a plan ready to mitigate it. Assign someone to document the engagement so that they can provide a historically accurate record and make it accessible to all parties. The unlimited cloud-based storage in a Diligent board management software program is the perfect place to store the records so they're accessible to all who need them.

- Set an Action Plan

Select one reason for investor engagement and use it to guide the entire process. Be clear on the composition of the group.

Groups that meet more than one time will expect to be reimbursed for their expenses. Determine early whether participants will receive some sort of financial compensation or whether they will be offered travel expenses only. Be sure to be equitable and transparent about compensation and reimbursement.

Final Words on Improving Your Investor Engagement Strategy

This step-by-step guide to an investor engagement strategy will help to sustain constructive relationships over time. Board directors can utilize this process to create shared value.

As with any other board director meeting, investors should be given clear guidelines about confidentiality. Finally, the leader of the group should periodically schedule at least an annual meeting for follow-up and continuity.