Environmental, social, governance (ESG)

ESG is a practice in which investors consider a company’s environmental, social and corporate governance impact when making investment decisions. This makes ESG not only a priority for investors but also an imperative for corporations that want to both attract more shareholders and satisfy those they already have.

Here’s what corporations and their boards need to know given that ESG investing is here to stay. We'll cover:

- What ESG is

- How the ESG movement took hold

- What a commitment to sustainability looks like in practice

What is ESG?

ESG means “environmental, social and governance,” representing a more stakeholder-centric business approach. So, what is ESG? It is a framework used to assess the sustainability and ethical impact of a company's operations and practices. It is set on the principle that the environment is only one factor in determining an organization’s commitment to sustainability.

Companies that adhere to environmental, social and governance standards agree to conduct themselves ethically in those three areas. This commitment can draw on various strategies, tactics and ESG solutions. As ESG increasingly becomes top of mind for directors, it’s essential to consider the global nuances that drive focus region by region.

ESG factors

To better understand the meaning of ESG, an excellent first step is to identify the factors within the environmental, social and governance categories.

Examples of these ESG factors include:

Environmental

Preservation of our natural world concerning factors like:

- Climate change

- Carbon emission reduction

- Water pollution and water scarcity

- Energy efficiency

- Air pollution

- Deforestation

- Greenhouse gas emissions

- Biodiversity

Social

Consideration of humans and our interdependencies:

- Customer success

- Data hygiene and security

- Gender and diversity inclusion

- Community relations

- Modern-day slavery

- Mental health

- Child labor

Governance

Logistics and defined processes for running a business or organization:

- Board of Directors and its makeup

- Executive compensation guidelines

- Political contributions and lobbying

- Tax strategy

- Risk management

- Venture partner compensation

- Board composition and refreshment best practices

- Anti-bribery strategy

What is the ESG movement?

The ESG movement reaches back to the 1960s, when investors began to prize social responsibility. Many investors of the time, for example, refused to invest in companies with ties to South African apartheid.

As deep as ESG’s roots run, the concept as we know it took hold in the mid-2000s and was codified in a 2004 report from the UN. Then and now, ESG is based on the idea that corporations have the power — and the responsibility — to effect change.

ESG is critical on many levels, including:

- For society: ESG investing may drive the search for solutions to the many challenges we face — from climate change to human rights violations to equity in the workplace.

- For investors: ESG performance has been shown to correlate strongly with financial performance; companies in the S&P 500 that ranked in the top quintile for ESG factors outperformed those in the bottom quintile by more than 25 percentage points between the start of 2014 and the end of June 2018.

- For corporations: ESG is a business opportunity for open-minded corporations, as these issues shape consumer expectations. Among millennials, 83% of consumers support brands that align with their values.

- For governments: Increased focus on ESG across the business and political spectrum has made this a vital issue for governments, exemplified by imperatives like the publication of the 2021 IPCC report on climate change that renewed the ESG focus.

ESG myths

Though ESG is a priority for many, it’s also controversial. Many lawmakers believe ESG is a political calling card that detracts from generating real shareholder returns. This backlash, though, is largely tied to ESG myths that are easily misunderstood — but are even easier to debunk.

A few of these myths include:

- ESG is a poor use of resources: For most companies, adopting ESG principles will require an up-front investment. That investment often pays for itself, though, given that it can also cut costs by reducing employee attrition, lowering the risk of penalties for noncompliance and stabilizing the supply chain.

- ESG isn’t a good investment: There are lawmakers, investors and even corporations who claim that investing based on ESG isn’t profitable. However, intangible assets like reputation account for more than 80% of an organization’s S&P asset value, and Stock prices of companies with high ESG rankings also tend to be less volatile, whereas “high ESG controversy” events can cause a company’s stocks to underperform the market for as long as two years.

- ESG is too difficult to track: Because ESG is multi-faceted, some feel that it can be difficult to truly track and manage. How can someone really know they’re making a sound ESG investment? While corporate ESG practices have evolved, they are currently quite strong. Many boards leverage ESG tools, and 90% of S&P companies have an ESG strategy, making ESG trackable and transparent.

ESG investing

For investors, environmental, social and governance considerations are a growing priority. As our environment changes, new risk factors are cropping up for investors, and new regulations are being enacted to mitigate the effects of environmental damage.

All of this has resulted in what we now call ESG investing. Here we'll clarify:

- The meaning and history of ESG investing

- Impact investing vs. ESG investing

- Whether ESG investing is good or bad

- Why it is important

- How ESG investing works

- Types of ESG investing

- The ESG investing rule

What is ESG investing?

ESG investing definition: Selecting investments based on the company’s policies and practices regarding environmental, social and governance issues.

![For investors, ESG is broadly a checklist to say yes, you know the companies in our portfolio […] have these factors, and that should lead to better returns. - Quote from Ezekiel Ward, the founder of North Star Compliance Limited](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F33u1mixi%2Fproduction%2F881931a41f0ce88ef249ed495089b8cea9a5f47b-1940x696.png%3Ffit%3Dmax%26auto%3Dformat&w=2048&q=75)

Droughts, food insecurity, and rising temperatures have a domino effect on the environment that impacts multiple sectors. As a result, investors want to address those new risks and take action to prevent them. ESG investing is their solution.

ESG investing also signals a changing of the guard. Today’s generation of investors is on the receiving end of a massive wealth transfer from the Boomer generation — as much as $68 trillion, according to one report by CNBC.

$15-20 trillion of that money could go into ESG assets in the next couple of decades, according to a 2016 Bank of America report on ESG investing. If that happened, it could roughly double the size of the U.S. market.

!["[...] there is an extensive body of evidence that environmental, social and governance factors can have material impacts on certain markets, industries and companies." — 2023 Statement from the White House](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F33u1mixi%2Fproduction%2F6085285d9f54b8fab447797125c73a3b23fb1c4a-1941x696.png%3Ffit%3Dmax%26auto%3Dformat&w=2048&q=75)

View full 2023 Statement from the White House

When did ESG investing start?

ESG investment started in the 1960s. While certain ethical concerns have changed, the principle of sustainable investing remains the same. More and more investors are adopting ESG criteria, evaluating their potential investments with an emphasis on how effectively corporations navigate people and planet, not just profit.

According to a report by PWC, the practice of ESG investing has grown over the last few years. The report states that the ESG asset pool will continue to grow rapidly and become essential in the investment process in the coming years.

The growth of ESG investing can be boiled down to three reasons, according to financial firm MSCI:

- The world as we know it is changing.

- The next generation of investors is changing the way investment works.

- Data and analytics have evolved to provide more information than ever.

What is the difference between ESG and impact investing?

Both ESG investing and impact investing are purpose-driven, but the difference has to do with the investors’ priorities. ESG investors consider the ethical implications of a corporation’s environmental, social and governance policies, while impact investors are more concerned with driving social change through their investment.

Is ESG investing good?

ESG investing is good, both for the world around us and the investors’ return. People used to believe that ESG investments were a sacrifice — an investment more morally than economically motivated. Today, that isn’t necessarily true.

In fact, according to a report by the US SIF Foundation, ESG investing grew at a rate of more than 38% between 2016 and 2018. Assets grew from a total value of $8.7 trillion to $12 trillion.

Some studies have even suggested that companies with good ESG practices had lower capital costs and volatility. They also displayed lower instances of bribery, fraud, and corruption over time. These results suggest that, in the long run, ESG investments are more stable and can even outperform other companies.

Why is ESG investing important?

ESG investing is important in many ways. 80% of the world’s largest companies have reported exposure to climate change-related risks, while climate-related events could cost those businesses $1.6 trillion by 2026. ESG is an important way to insulate against those risks.

ESG investing is also financially important. In a recent study, MSCI investigated the ties between ESG investments and the stock market, to see if there were any financially significant effects. The study used a three-channel model to look at how ESG data embedded in stocks gets transferred to the equity market.

The study found that, after examining idiosyncratic and systematic risk profiles for the companies involved in the study, ESG affected many of those companies’ valuations and performance. Companies with higher ESG ratings showed:

- Higher profitability: ESG companies with high ratings showed abnormal returns and were more competitive. This often led to higher profitability and dividend payments — especially when contrasted against low ESG companies.

- Lower tail risk: High ESG-rated companies experienced fewer idiosyncratic risk events like major drawdowns. Companies with low ESG ratings were more likely to experience these incidents.

- Lower systematic risk: High ESG companies had less volatile earnings and less systematic volatility. They also had lower betas and lower costs of capital than low ESG-rated companies.

ESG investing can also cut risk in emerging markets. There is research to suggest that companies adhering to ESG principles have a lower chance of tail risk — the risk of unlikely events that lead to catastrophic damage.

How ESG investing works

ESG investing works by giving equal weight to a company’s finances and its social impact. In ESG investing, an investor will evaluate how a corporation operates, how it relates to its community and how it impacts the environment to inform their investment decision.

If the corporation is found lacking in any of those areas, ESG investors are likely to move on.

Types of ESG investments

Like traditional investing, ESG investors can invest in a variety of different products with the help of a robo-advisor or broker. These include:

- Stocks: An investor can buy stocks in a company with satisfactory ESG performance. Before investing, the broker and investor should review documents like the financial report, shareholder report and ESG report to verify that the company’s approach to ESG aligns with their expectations.

- Mutual funds and ETFs: These are investment portfolios comprised of multiple different securities, most commonly stocks and bonds. An investor can choose an ESG fund that’s already assembled a portfolio of ESG-focused companies. It’s important to research the specific fund, though, since each may have different investment priorities.

What is the ESG investing rule?

The ESG investing rule is a rule from the Department of Labor related to retirement funds. It allows companies that administer retirement plans covered by the Employee Retirement Income Security Act to consider ESG criteria in their investments.

This doesn’t change the fiduciary duty companies have to protect their investors’ assets, but it does expand the asset classes they can consider — signaling, once again, that the emphasis on ESG isn’t likely to go away.

Corporate ESG

Though ESG ties back to investing, investors have also swayed corporations to take ESG issues seriously. This has shaped not only the meaning of ESG for corporates and conversations in the boardroom but activities throughout the entire corporate value chain.

Since the threats facing society will likely continue to loom, ESG will also remain a critical focus for investors in the coming decades. That makes corporate ESG an equally significant topic for corporations and their boards.

What does ESG mean in business?

In business, ESG equates to a business opportunity. Corporations can take a strong stance on ESG issues and signal to investors that they care about both generating reliable returns and mitigating their environmental and social impact.

Because not every corporation has adopted ESG equally, it’s also an opportunity for corporations to differentiate themselves. Those who take a systematic and strategic approach to ESG can carve out a reputation as ESG leaders in their industry — the kind of organizations young investors want to support.

![When it comes to ESG, corporates are looking at this through the lens of business opportunities; […] new markets that they can open up and sell to, cost reductions, and also integrated risk management. - Quote by Ezekiel Ward, founder of North Star Compliance Ltd.](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F33u1mixi%2Fproduction%2F399bea9666aed80a86fbd978db10f63ddc791786-1940x696.png%3Ffit%3Dmax%26auto%3Dformat&w=2048&q=75)

How ESG differs from other acronyms

The boardroom is full of acronyms. While the ESG acronym can feel like another to add to the pile, it’s distinct from other acronyms that might circulate — all of which are important in their own way. Some of the acronyms to know are:

- ESG vs. SRI

- SRI stands for socially responsible investing, and it’s more akin to impact investing than ESG investing. SRI investors are most concerned with the social impact of their investments, whereas ESG investors typically also consider company operations.

- ESG vs. GRC

- Governance, risk and compliance (GRC) share governance with ESG. As a result, GRC can be considered an element of ESG — a business’s GRC practices would be related to its governance-related ESG targets.

- ESG vs. CSR

- CSR, or corporate social responsibility, refers to a company’s approach to sustainability. Because it’s self-regulating, CSR can be a valuable companion to ESG, but ESG holds corporations to a higher standard.

ESG and the board

The relationship between ESG and the board of directors is still being defined. As it stands:

- Discussions around the “G” (i.e., governance) are often spearheaded by the nominating & governance committee with involvement from the full board — particularly when assessing how these risks integrate with the enterprise risk management (ERM) program or impact long-term strategy.

- More boards are incorporating the “S” (social considerations or corporate impact) into the strategy development process. According to PwC’s Annual Corporate Directors Survey, issues like health care cost, resource scarcity, human rights, and income inequality have all surged in importance.

- When it comes to structuring oversight around the “E” (i.e., environmental issues), a recent global study by the Diligent Institute found that best practices are still largely undetermined. Half of the 447 survey respondents indicated some form of board-level oversight, either by the full board or a board committee, while 19% indicated that oversight lived within the organization. Another 35% percent indicated that environmental issues are “not overseen” by the company or that they “don’t know.”

- With ESG scores and rankings increasingly being published in the public domain, the importance of investing in ESG-focused organizations is growing. Published ESG metrics are attracting investor attention, increasing the importance of tools like ClarityAI — Diligent’s partner for generating science-based risk scores.

What are ESG examples?

Many corporations struggle to envision ESG in practice. But ESG strategies are more widespread than you might think. The following are some common boardroom topics that are also prime ESG examples:

Environmental examples:

- Minimizing your carbon footprint to fight climate change

- Reducing greenhouse gas emissions

- Using renewable energy throughout your value chain

Social examples:

- Giving back to the communities in which you operate

- Creating an equitable and safe working environment

- Treating your customers with dignity and respect

Governance examples:

- Offering pay transparency and pay equity across your organization

- Assembling a diverse board of directors

- Holding employees and leaders accountable for unethical practices

Corporate ESG trends

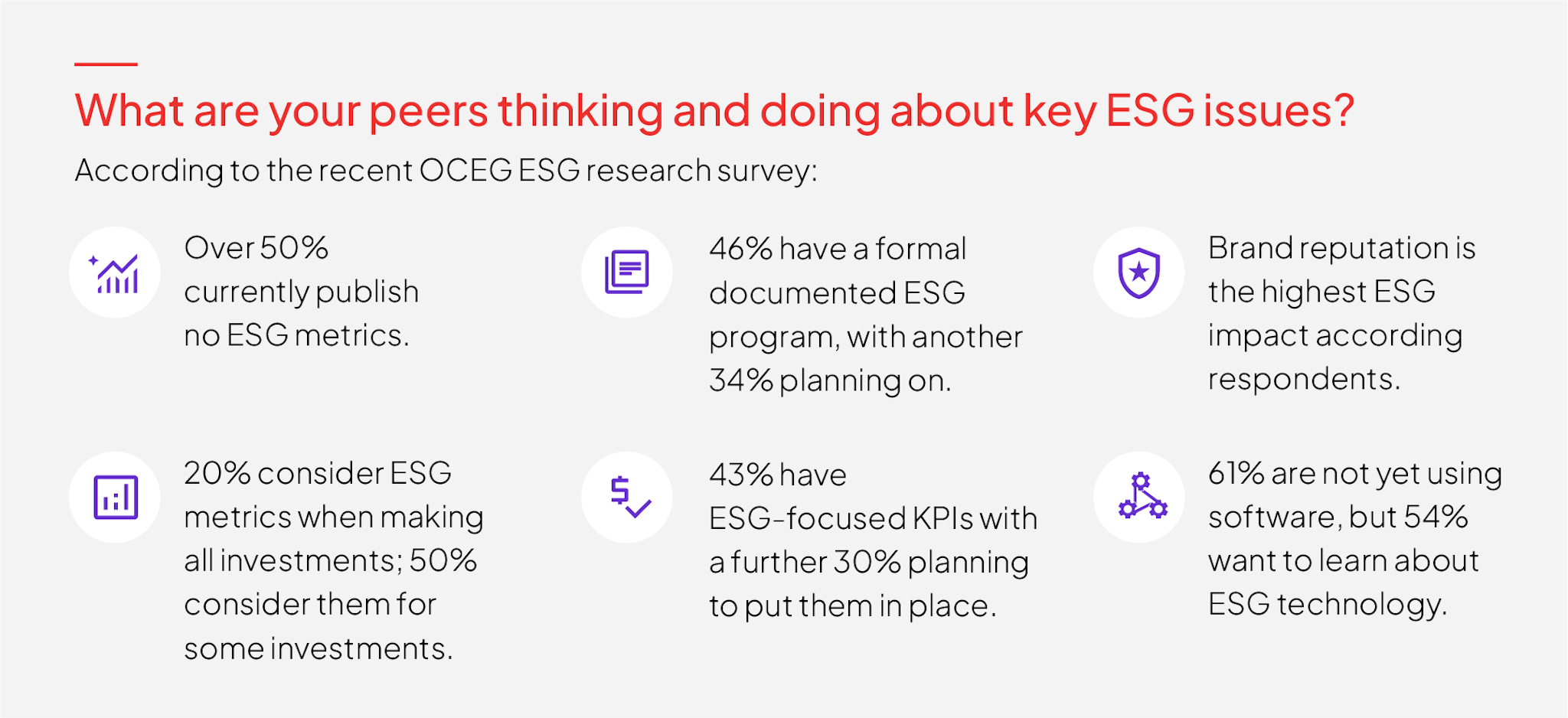

According to the recent OCEG ESG Research Survey, corporates are currently at the following stages of implementing, documenting and disclosing ESG risks:

ESG metrics:

- Over 50% currently publish no ESG metrics

- 20% consider ESG metrics when making all investments; 50% consider them for some investments

- 37% do not consider ESG metrics when evaluating vendors or suppliers

- 44% report that their investors do not consider ESG

- Only 20% report increasing alignment between ESG metrics and executive compensation

- And less than 10% say the same for compensation across the organization

ESG disclosures:

- 46% have a formal documented ESG program, with another 34% planning one

- 43% have ESG-focused KPIs with a further 30% planning to put them in place

- 30% have undertaken an ESG assessment in the last year

- Only 9% are highly confident that their organization has mature, well-documented ESG policies

ESG risks:

- Brand reputation is the highest ESG impact according to respondents

ESG technology:

- 61% are not yet using software, but 54% want to learn about ESG technology

Building an ESG program with 10 steps and resources

The road to effective ESG initiatives isn’t always easy, largely because they're iterative. ESG success isn’t just adding a recycling program or offsetting your carbon emissions. It’s that, plus a systematic approach to making your operations sustainable — and your sustainability defensible. To do that, modern boards need to:

- Identify ESG risks: Environmental, social and governance-related risks are on the rise. Companies need to assess what their unique risks are so they can build a program that mitigates them.

- Implement ESG policies: Corporations should then document their stance on ESG issues, including specific expectations for their employees and vendors.

- Integrate ESG across the value chain: Once you have policies in place, you should expect your entire value chain to follow them. It’s not enough to compost in your corporate office if your vendors are improperly disposing of waste.

- Champion ESG diversity: Issues related to ESG are multi-faceted, so your leadership should be, too. Integrate diversity from the outset rather than addressing it as an afterthought. Reverse mentoring is another way to welcome diverse points of view.

- Avoid rainbow washing: As you implement your ESG strategy, remember that it’s important to walk the walk — not just talk the talk. Pretending to be an ESG advocate without taking real action can do more harm than good.

- Reduce your corporate footprint: Your corporate footprint refers to your impact on the environment. Take steps to reduce it, including through tools like carbon accounting.

- Enforce ESG compliance: Your ESG program will only be successful if your employees take it seriously. Set a culture of compliance from the top, as well as clear expectations and training to help your employees understand what true buy-in looks like.

- Create ESG reporting structures: Your reporting is a critical way to centralize your ESG data and prove to investors and regulators that you’re taking action. Consider incorporating GRI standards in your disclosures.

- Utilize ESG automation: As your ESG program grows, it may be difficult to maintain manually. ESG automation can free up time and resources, automating repetitive tasks and leaving your team to focus on ESG strategy.

- Leverage ESG technology: The right technology can support your ESG efforts, making it easier to hit your social and sustainability targets.

ESG tools for modern boards

ESG requires boards to be renaissance people. They have to continue to steer their company toward ever-growing returns while balancing the demands of transitioning to more environmentally, socially and operationally sustainable practices.

Still, environmental, social and governance issues shouldn’t be relegated to the passenger’s seat — they should be one of the main driving forces for modern boards leading modern corporations.

From board diversity to carbon accounting to scores, there’s an ESG tool for that:

- Benchmark ESG progress with science-based scores that drive a more strategic approach to ESG.

- Equip your leaders with the insights to innovate for ESG and the certificate to prove it.

- Generate more accurate reportsthat make your ESG program visible to your board and defensible to investors and regulators.

- Build a better board with the diverse backgrounds and experiences it takes to lead on ESG.