The Corporate Sustainability Reporting Directive is Here!

- Comply with the European Sustainability Reporting Standards (ESRS), which are expected to be adopted by summer 2023

- Obtain a third-party, certified audit of their reported information

- Apply double materiality standards, which show businesses’ ESG impact

- The CSRD is here

- Who is Impacted

- CSRD Requirements

- How to Prepare

In November 2022, the European Parliament voted to pass the Corporate Sustainability Reporting Directive (CSRD), requiring impacted companies to have their sustainability reports independently audited each year.

The directive, which will be implemented in 2024, is just one piece of a much larger ESG picture, and it’s not just European businesses that will be impacted — non-EU businesses generating at least €150 million inside the EU are also included under the new regulations.

From 2023, the CSRD will expand on and revise the EU’s 2018 Non-Financial Reporting Directive (NFRD). It will require companies to report through the European Sustainability Reporting Standards (ESRS) Annually, with electronically readable and searchable reports. These new requirements will help standardize sustainability metrics across the EU and increase transparency around corporate and sector-specific sustainability disclosures.

Previously, the NFRD covered 11,600 listed companies and banks with over 500 employees, the CSRD expands much further, covering all large & private & public companies that meet at least two of the following criteria:

- 250+ employees

- €20 million or more in total assets

- €40 million or more in turnover

The CSRD will cover many small and medium enterprises (SMEs), all large companies, all companies on listed markets, and international companies (e.g., non-EU companies) with subsidiaries operating within the EU. Qualifying SMEs will get three years to comply.

This could significantly transform ESG and corporate reporting requirements globally. The 49,000 companies covered by CSRD account for over 75% of all companies’ turnover in the EU, that’s 75% of all European business revenue.

The CSRD replaces the EU’s current ESG directive, the Non-Financial Reporting Directive (NFRD), and requires subject companies to:

- Comply with the European Sustainability Reporting Standards (ESRS), which are expected to be adopted by summer 2023

- Obtain a third-party, certified audit of their reported information

- Apply double materiality standards, which show businesses’ ESG impact on both their internal operations and outward-looking sustainability goals

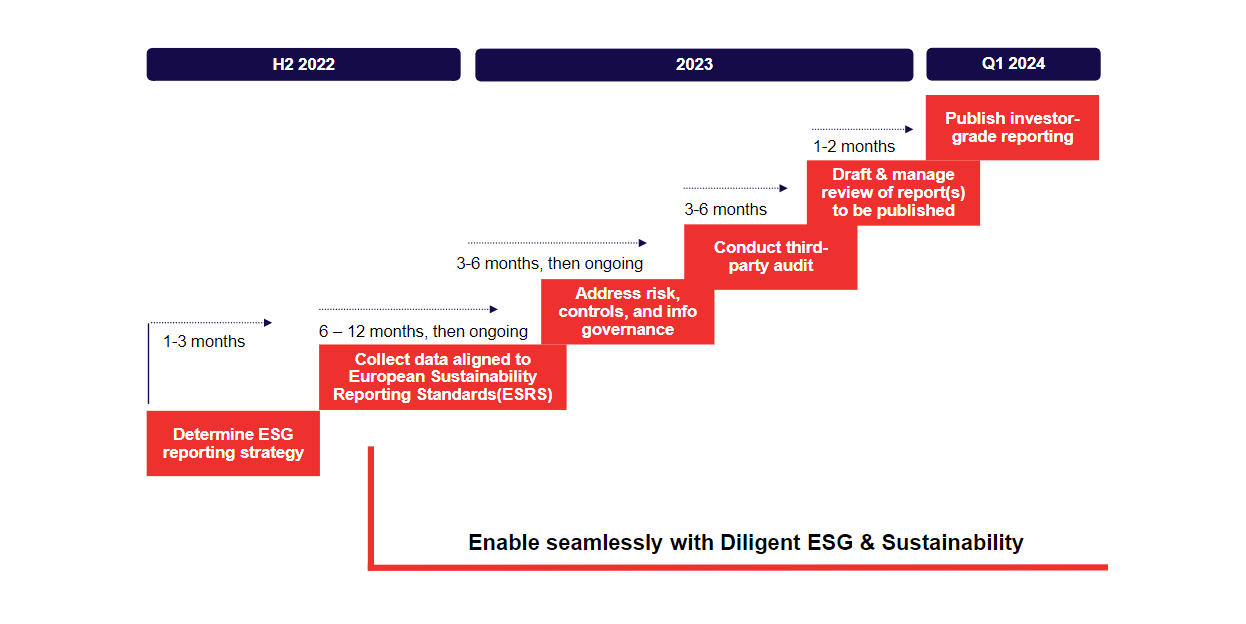

Whether your deadline to comply with the CSRD falls in 2024 or 2028, the complexity and critical nature of these new disclosure requirements make it imperative to act now. The following is a checklist that will help you prioritize next steps to ensure you have the right systems in place.

KNOW YOUR DEADLINES

There are several different deadlines for complying with the CSRD, so it’s important to understand which ones apply to your business.

Companies already subject to the EU’s existing NFRD will need to adhere to CSRD standards beginning in 2024, with initial reporting due in 2025. That means these companies need to prepare to plan and implement their compliance approach by 2023 in order to be ready for the 2024 reporting cycle. Other companies will phase in according to the following schedule:

- Large businesses will need to comply by 2025, with the first report in 2026

- Disclosures from SMEs follow in 2026, with reporting starting in 2027

- Non-EU companies subject to the CSRD would need to comply by 2028, with initial reporting due in 2029

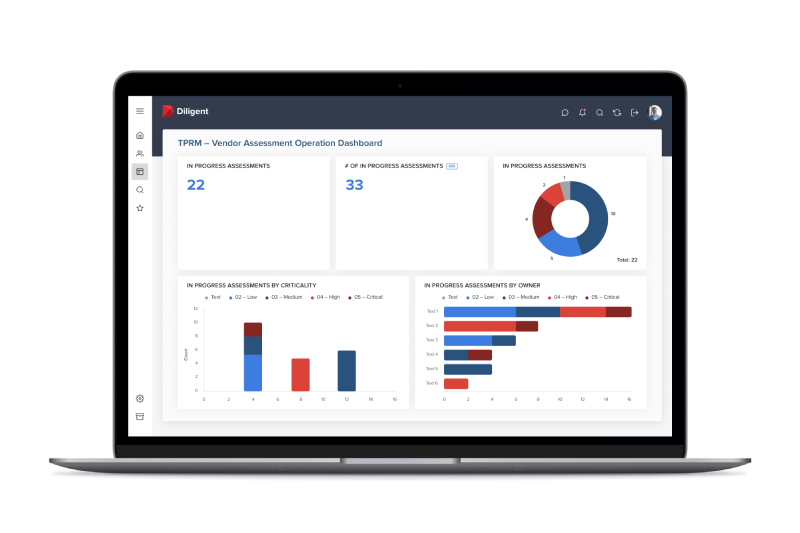

Diligent ESG Can Help You Prepare For The CSRD

Carbon Accounting by Diligent checks all of these boxes and more. It presents a single source of truth that can help your organization easily generate accurate sustainability reports by automatically collating your data. Access dozens of pre-built, auditable reports to save time and cut auditing costs related to emissions reporting.

Diligent’s ESG solution offers:

- Automated and auditable data collection, cleansing, analysis and reporting across over 2,000 fuels and business activities, including all Scope 1, 2, 3, CSR and supply chain data sources

- Automated checks for data anomalies and completeness

- 80 pre-built audit-ready reports, so there’s no need to create and configure new templates

- The ability to personalize your reporting and dashboards to reflect the formats and needs of your business (whether you’re reporting for the CSRD or other regulations)

Moreover, this carbon accounting software will help you build transparency and maintain stakeholder trust through comprehensive and reliable greenhouse gas reporting.

Take the next step to prepare for mandatory climate disclosures like the CSRD.

CSRD Insights and Resources